LG Display – Quick Notes

LG Display indicated that the high-end OLED TV market grew 10% in 1Q, while the overall TV set market saw a 10% decline y/y, with OLED TV set growth of 40% y/y, although OLED TV panel shipments were lower than expected. As noted above, LGD expects to see significant growth in OLED TV shipments in 2H and increasing profitability in the segment, although they were careful to add that the improvement would be on a ‘phase by phase basis.” We expect that at least a part of that OLED TV panel enthusiasm is related to thepotential deal between LG Display and Samsung Electronics (005930.KS) that we have noted in the past, but also on increased consumer familiarity for OLED TV in general. The company was a bit more vague toward expected improvements in their small panel OLED business, other than typical improving 2H seasonality, mentioning wearables, automotive, and more specifically ‘tandem OLED’ a technology that LGD is developing for Apple (AAPL). As part of the longer-term OLED plan, the company will see increased capex this year as it continues to spend on additional small panel OLED capacity at its E3 Gen 6 OLED fab (primarily for Apple), which it says remains scheduled for 2024, although we believe they could begin mass production sooner.

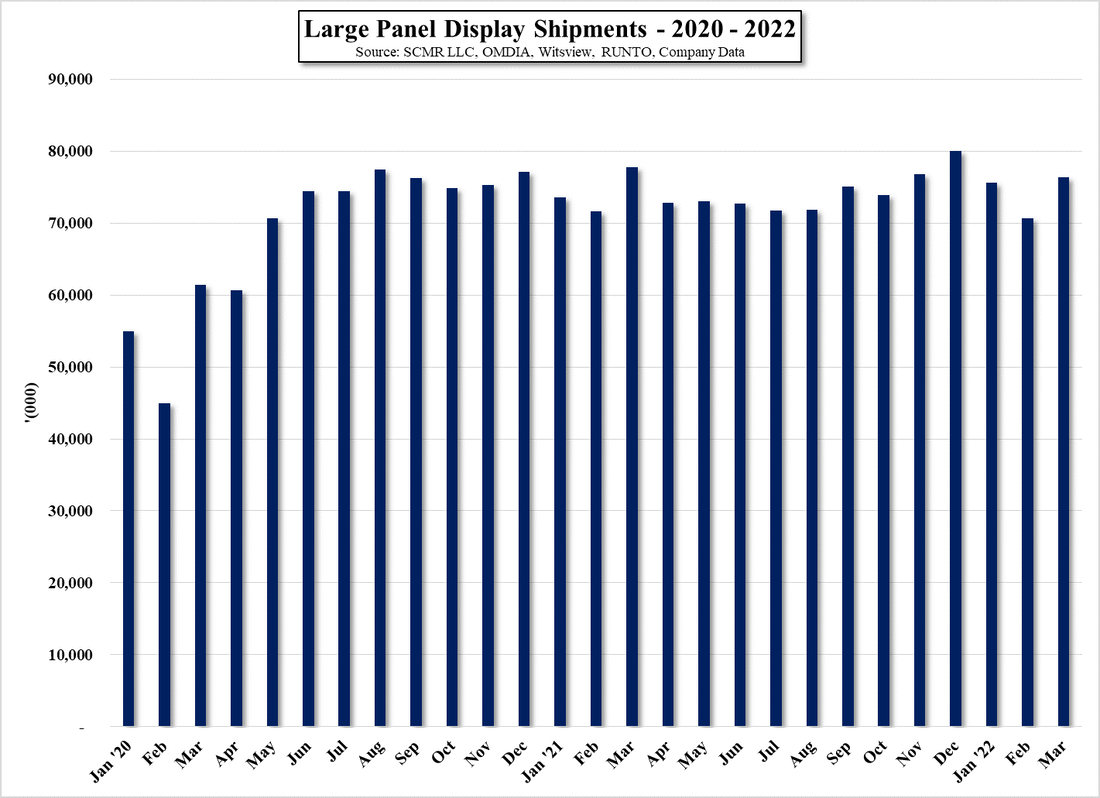

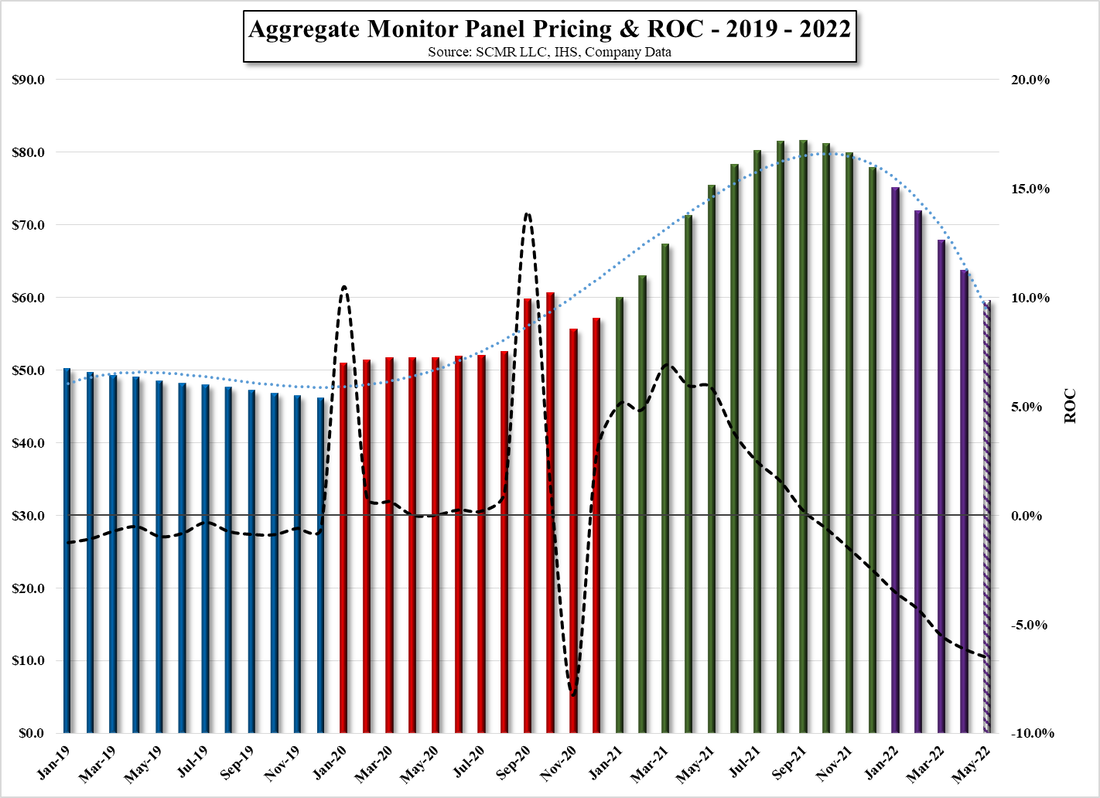

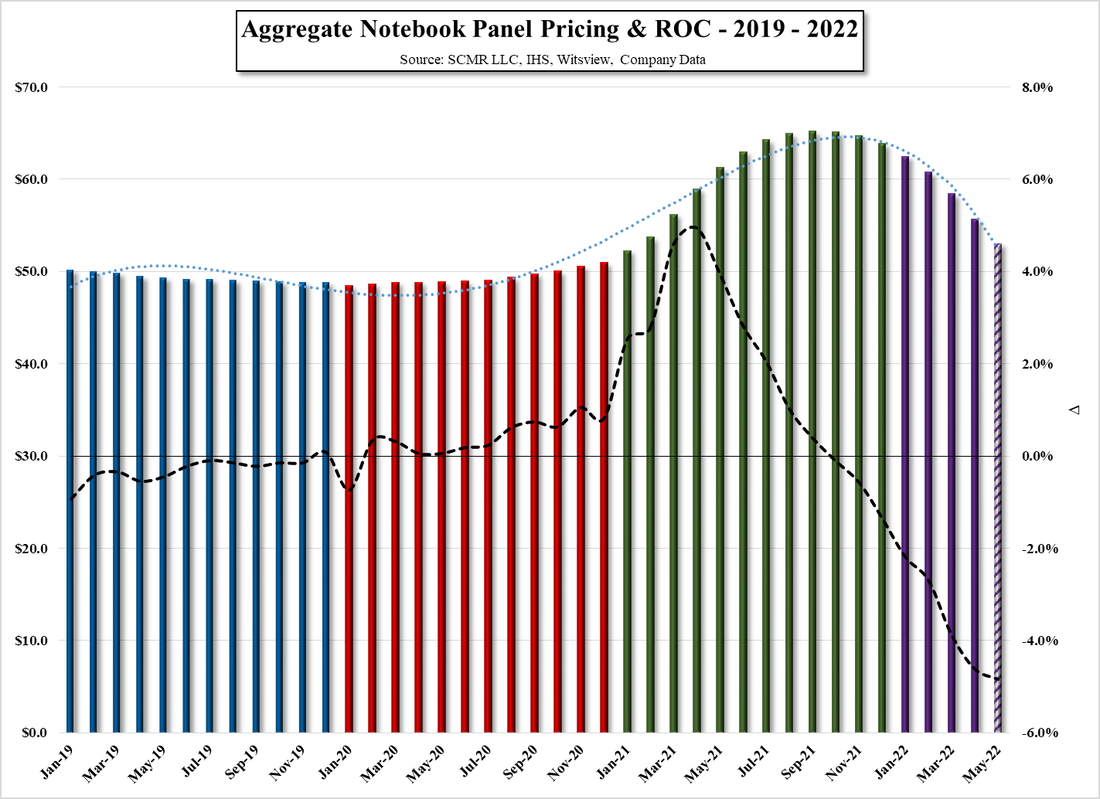

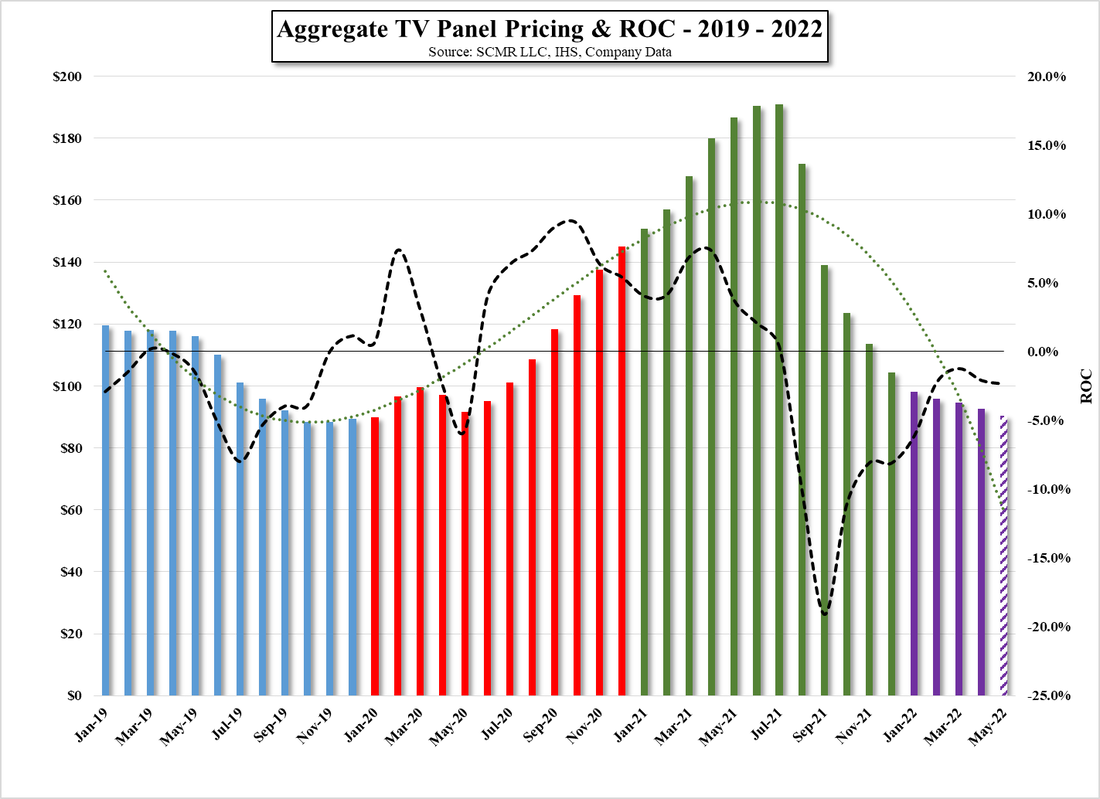

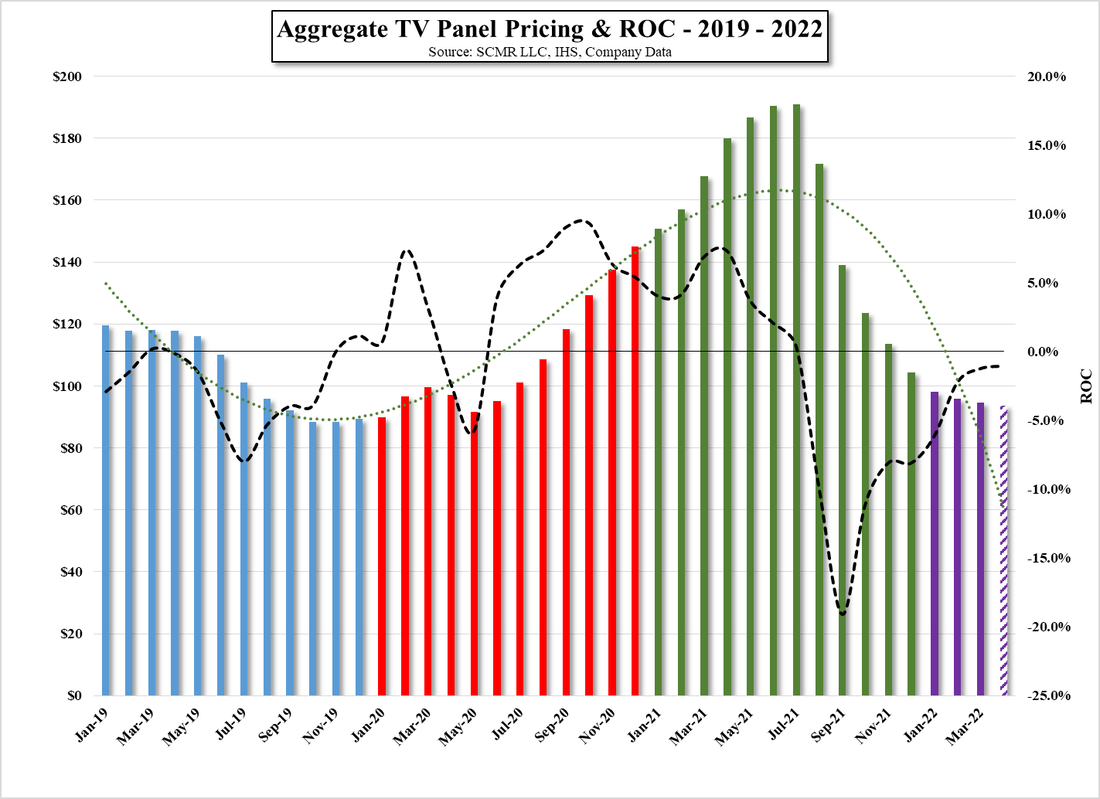

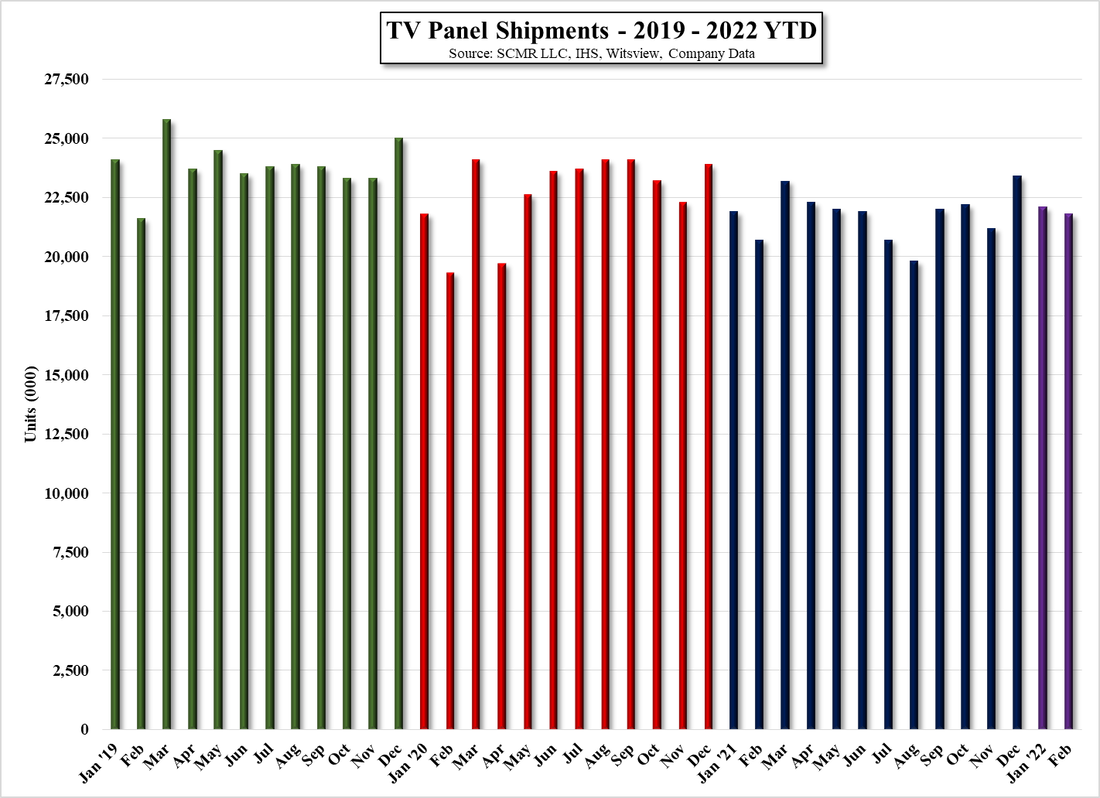

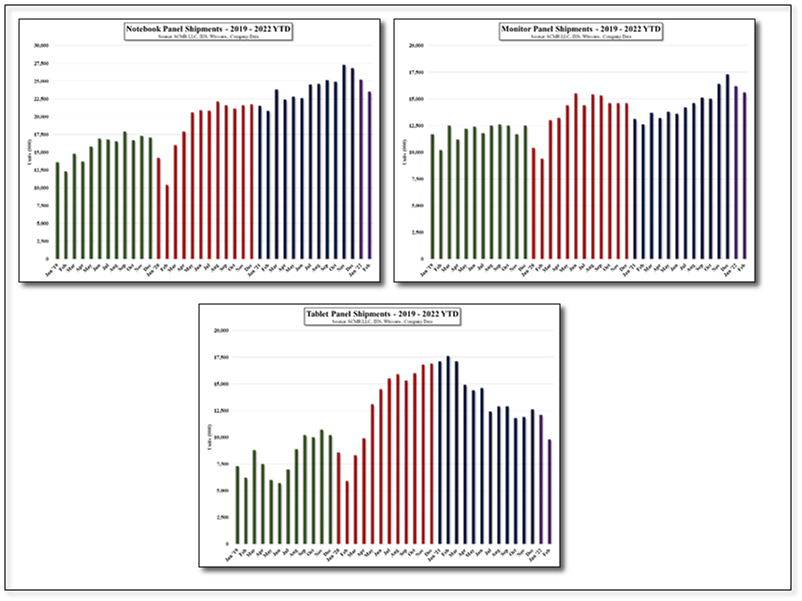

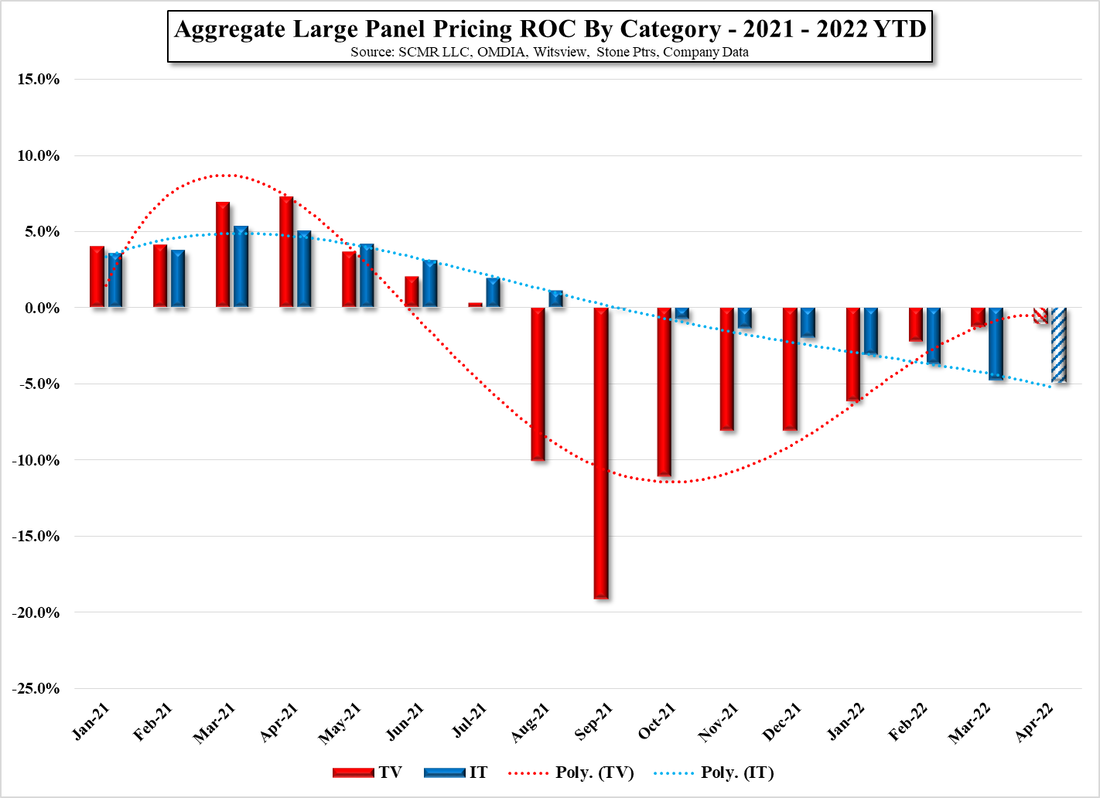

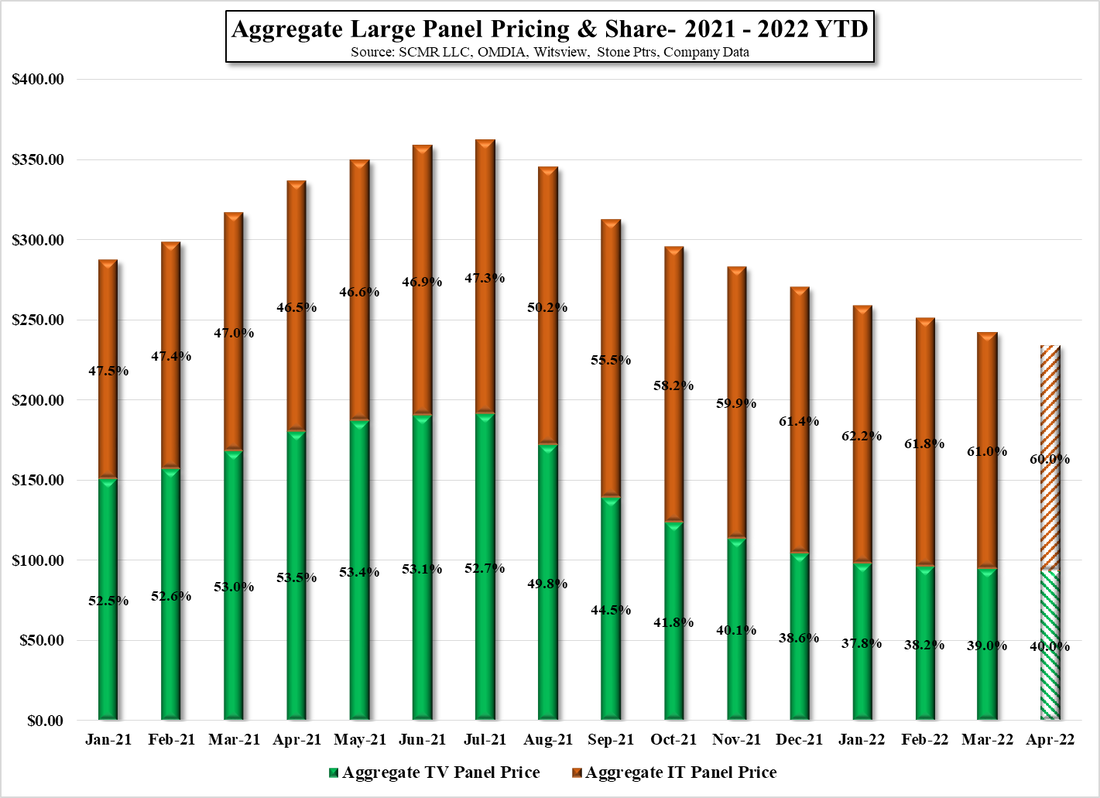

Questions on whether the slower growth of OLED TV panel shipments in 1Q would affect the total for the year was answered with “looking at the trend from April (then) we see that the shipment of OLED is likely to pick up from the 2nd quarter and alongside it the profitability as well”, which we found a bit lacking. As to the potential for changes in the company’s longer-term OLED plans, a boilerplate answer based on ‘the principles of profitability and growth’ would govern future investments. When queried about the LCD display business, LGD admitted that they had expected Chinese competitors to be ‘more disciplined’ as to pricing, but with such a decline in the market, they have become more aggressive toward pricing. The company is expecting to reduce the amount of generic LCD panels it produces to remain competitive, something a number of Taiwanese panel producers have done over a year ago, but the company also admitted that while it had expected B2C business to weaken as COVID was slowing, it had also expected B2B business to increase, which has been slower than expected. While that remains the case, the company added that current levels for B2B are still higher than they were pre-COVID.

The company was also asked about plans for its entry into the AR/VR display market but gave little information as to real plans, mostly citing the examination of the market and potential entry points and products, so nothing seems to be on the near-term horizon. When probed a bit further on the company’s view of LCD cyclicality, they stated that the “COVID boom” pulled in considerable demand which will lead to negative growth this year and could be sustained. They expect this to lead to a potential improving situation based on supply rather than demand, meaning more utilization cuts in the near term and the closing of older, less efficient fabs going forward. It was not apparent whether they were speaking about LG Display's older LCD fabs or ones across the industry, but LGD does have Gen 5 fabs that were commissioned in the early 2000’s and are still operational that it could close or upgrade, although expecting Chinese panel producers to close older fabs might take a more sustained downturn.

All in, we expect LG Display’s call to be rather typical for panel producers this quarter, although they are lucky enough to have OLED as an offset to the LCD display weakness. Once again panel producers seem to be shocked about the end of what was a partially artificial ‘boom’ in LCD display demand. Some producers have the experience to know that building into the peak of a cycle is not the best idea, while others were moving away from LCD TV panel production before COVID-19 began. That said, those more interested in gaining market share will now face the reality of low or no profitability as the industry faces a more normalized reality going forward. Display is a cyclical industry so as Roseanne Roseannadanna said “It’s always something!”.

RSS Feed

RSS Feed